One of the keys to a better version of you, mentally and physically, is sleeping well. We want all of our industry members to sleep as well as they can that’s why EIC have partnered with Sleepstation. Sleepstation is a clinically validated sleep improvement programme that can help you learn how to control and optimise your sleep to get the best sleep possible. Designed by experts and backed by science, the online service is proven to combat even the most severe insomnia. Their team will help you identify the underlying causes of your sleep problem and provide the personal support and guidance needed to improve your sleep. Sleepstation delivers remote care with a personal touch and that's what makes it so effective. Therapeutic support through Sleepstation is available to those in need and meeting our charity eligibility criteria.

All of us have financial wellbeing and having positive financial habits can have huge impact on our physical and mental wellbeing. For a lot of us finances are still a taboo topic but it is important to address our finances and understand how we can keep them looking as healthy as we can.

It's probably not news to you that the state of your finances can have an impact on your mental health. According to the Money and Mental Health Policy Institute, around half of adults in the UK who are in problem debt also have some form of mental health issue, while people who are in significant levels of debt are more than twice as likely to develop major depression as those with no debt worries at all. As such, developing a state of financial wellbeing is really important, not only for the health of your finances but for your mental health too.

Health Challenge: Financial Wellbeing Challenge:

There are some areas where we can all cut back on spending. Join our financial wellbeing challenge and save the money towards something you’ve been wanting to purchase for a long time or just gain new, positive financial habits.

Why?

Financial wellbeing is something all of us have. Financial habits can have positive or negative impact on our physical and mental wellbeing. Therefore, we encourage you to look through your financial everyday habits and see how you can improve things for the long run. You will be surprised how much money you could save after only one month of doing this.

How?

- Pick one thing that you think most of your unnecessary spending is on and don’t spend any money on it this month. You may choose to cut out your fancy coffees, takeaways or clothes shopping or decide to go all in and cut back on all unnecessary expenses.

- Post the above image on your social media channels and tag @electricalcharity #FinancialWellbeing

‘I am giving up [INSERT WHAT YOU’RE GIVING AWAY] this month for EIC Financial Wellbeing Challenge and donating [INSERT NUMBER] % of the money saved to EIC! Join me and create positive financial habits in your life while supporting our industry! https://bit.ly/3mlapVj @electricalcharity #FinancialWellbeing

- Donate a percentage of the money saved this month to EIC so we can continue supporting people going through financial hardship in our industry: https://bit.ly/3pHkGxJ

While definitions vary, at its core financial wellbeing is simply having a sense of security over your finances, the feeling that you are in control of your money and have some element of choice over how and where you spend it. It’s important to recognise that this isn’t simply about the size of your salary. A study by SalaryFinance found that the two income groups that are most likely to have money worries were those with salaries of £10,000-£15,000 but also those earning above £100,000 a year. In other words, just because you have an above average salary, it doesn’t mean that you necessarily feel in control of your money, nor are you immune to fretting about your financial future.

Why financial wellbeing matters

If you have money concerns, this can have a knock-on effect on all sorts of areas of your life. This may start with sleepless nights but can easily develop into full blown anxiety or panic attacks, or even depression. And as it may be difficult to take your mind off of those financial worries, this can then feed through into becoming distracted at work, as well as taking a toll on your relationships with your family and friends.

All of us may experience financial hardship in our lives but for some of us the consequences of the pandemic hit really hard. Many of our sector colleagues who were self-employed or furloughed struggled to make ends meet and with a 20% reduction in wages for some coping day-to-day was difficult. From March- December 2020, the Electrical Industries Charity awarded 1,343 grants to industry members to support them through this trying time. Tim and his two daughters received an emergency financial assistance grant after Tim caught COVID-19 in May 2020.

Tim had worked as a self-employed electrician for five years and continued to work during the pandemic as he was considered an essential worker. Tim was a single father and both his young daughters attended school during the period. Unfortunately, while within school, his eldest daughter contracted COVID-19 which quickly spread throughout the household. Tim had to isolate within the home for 14 days. While at home Tim’s condition worsened. He became increasingly breathless, suffered with relentless coughing fits and struggled to take food or water. Concerned, Tim rang NHS 111 and was hospitalised. Tim’s sister moved into his family home to care for his daughters. After a stint within ICU Tim was discharged after a fortnight’s stay within hospital.

Once home Tim was incredibly weak, and his sister was furloughed so she could continue to care for Tim and her nieces. Tim’s financial resources were significantly depleted. Work had been scarce throughout the pandemic and now he had been unable to work for almost a month. Him and his children were depending on his sister’s reduced wage. Tim’s financial worry was hindering his recovery, so he contacted the Electrical Industries Charity. The Electrical Industries Charity assigned Tim a caseworker who established Tim’s financial circumstances, income, and expenditure. It was clear Tim needed some financial aid to support his family and safeguard his recovery. Tim completed a financial assistance form provided by the charity and he was awarded a grant to support his income in the short term. His charity case worker also helped Tim to apply for universal credit which would help him get by until his circumstances improved. The Electrical Industry Charity case workers are well versed in the welfare systems in place and can help sector colleagues to understand what benefits they are entitled to and how they can receive them. The charity also encouraged Tim to speak to his bank for a mortgage holiday. Mortgage holidays do not affect your credit score or interest rate but provide a period of respite for those struggling to meet their mortgage payments.

By the Summer of 2020 Tim was ready to return to work and he was able to find a contract role which provided some stability and security for his family. The Electrical Industries Charity had since closed Tim’s case and Tim was grateful for the financial support and guidance provided by the charity team.

If you need are struggling in a trying time contact The Electrical Industries Charity welfare team on This email address is being protected from spambots. You need JavaScript enabled to view it.

or call 0800 652 1618.

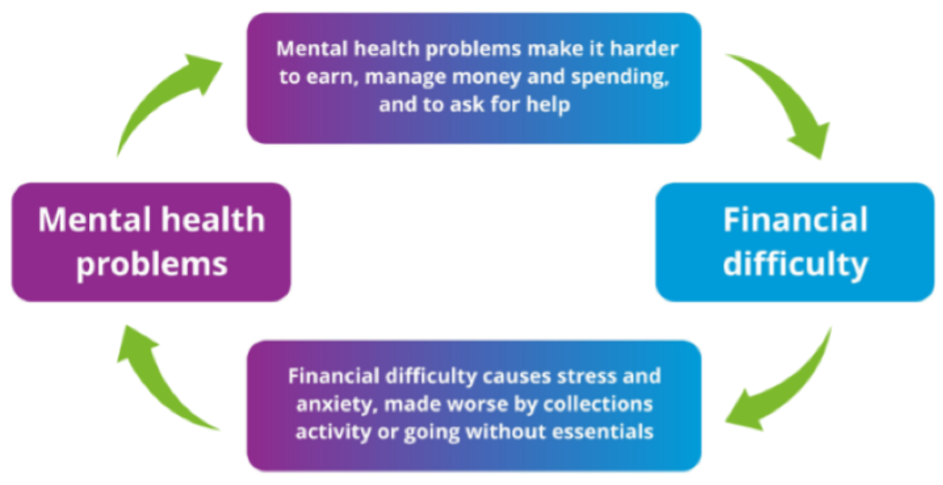

Mental health and money problems are often intricately linked. One problem can feed off the other, creating a vicious cycle of growing financial problems and worsening mental health that is hard to escape.

- Across England more than 1.5 million people are experiencing both problem debt and mental health problems.

- People in problem debt are significantly more likely to experience mental health problems

- Half (46%) of people in problem debt also have a mental health problem.

- 86% of respondents to a Money and Mental Health survey of nearly 5,500 people with experience of mental health problems said that their financial situation had made their mental health problems worse.

- Almost one in five (18%) people with mental health problems are in problem debt.

- People experiencing mental health problems are three and a half times more likely to be in problem debt than people without mental health problems (5%).

- 72% of respondents to Money and Mental Health’s survey said that their mental health problems had made their financial situation worse.

Financial difficulties are a common cause of stress, and stigma around debt can mean that people struggle to ask for help and can become isolated. The impact on people’s mental health can be particularly severe if they resort to cutting back on essentials, such as heating and eating, or if creditors are aggressive or insensitive when collecting debts. Financial difficulty drastically reduces recovery rates for common mental health conditions. People with depression and problem debt are 4.2 times more likely to still have depression 18 months later, compared to people without financial difficulty.

People in problem debt are three times as likely to have thought about suicide in the past year. Suicide is a complex phenomenon and there are usually a range of social factors, life events and other circumstances that drive someone to think about it. However, there is a strong link between problem debt and suicide. More than 100,000 people in England attempt suicide while in problem debt each year.

How does having a mental health problem affect your finances?

Income:

People experiencing mental health problems are less likely to be in paid employment, and more likely to be in low-paid employment. Only 43% of people with mental health problems are in employment, compared to 74% of the general population and 65% of people with other health conditions. People with mental health problems are also overrepresented in high-turnover, low-pay, part-time or temporary work. Some people experiencing mental health problems will be reliant on benefits when they are unable to work. A third of Housing Benefit claimants (35%) - and nearly half (47%) of adults aged 16-64 in receipt of some kind of out of work benefit - have a common mental disorder, such as depression or generalised anxiety disorder. This rises to two thirds (66%) of people claiming Employment and Support Allowance (ESA), a benefit aimed at those unable to work due to poor health or disability.

Expenditure:

Mental health problems can shape how our minds work and how we behave, as well as our emotions. Common symptoms of mental health problems, such as increased impulsivity and memory problems, can make it harder to keep on top of financial management or to get a good deal in complex markets, increasing the likelihood of financial difficulty. Many people with mental health problems report that their spending patterns and ability to make financial decisions changes significantly during periods of poor mental health. A Money and Mental Health survey of nearly 5,500 people with mental health problems found that, while unwell:

Mental health problems can also make it harder to engage with essential services, such as banks and energy companies. People can struggle to understand bills and remember account details, which can lead to financial difficulties and distress. Four in ten (37%) people who have experienced mental health problems exhibit significant levels of anxiety when dealing with essential services, including symptoms such as a racing heart or trouble breathing.

Mental health problems can also make it harder to engage with essential services, such as banks and energy companies. People can struggle to understand bills and remember account details, which can lead to financial difficulties and distress. Four in ten (37%) people who have experienced mental health problems exhibit significant levels of anxiety when dealing with essential services, including symptoms such as a racing heart or trouble breathing.

Communicating with essential service providers can be a particular issue. Three quarters (75%) of people who have experienced mental health problems have serious difficulties engaging with at least one common communication channel, such as using the telephone, face-to-face contact or opening post. Telephone calls are the most commonly problematic. More than half (54%) of people who have experienced mental health problems find the telephone difficult or distressing to engage with. If alternative channels aren’t offered, these difficulties can prevent people from accessing support and addressing problems with their account.

However, firms might find it difficult to identify customers experiencing mental health problems. Many people will not disclose mental health problems to essential services providers, often due to stigma. And a third (36%) of people experiencing a common mental disorder like depression or anxiety have never received a diagnosis and might not even know what they are experiencing is a clinical mental health problem.

Having a flutter on the football or trying your hand on the slot machines can be a great way to have fun when done responsibly but when gambling becomes out of hand and we become addicted it can be a steady spiral into financial struggle. Within the UK 350,000 are suffering with a gambling addiction and nearly 1.4 million people are problem gamblers. A gambling addiction can be life destroying and can really impact the sufferer’s wellbeing.

Grant, an employee of an electrical wholesaler, had been a problem gambler for many years but his addiction really spiralled when he was furloughed from work. He found it difficult to keep himself occupied and with hours of the day stretching ahead of him Grant began to gamble more and more. Grant’s reduced wage also meant his gambling addiction was starting to seriously impact his financial as well as his mental wellbeing.

Grant started to rack up considerable debt and when he returned to work, he was in a financial hole. Grant had attended wellbeing presentations facilitated by a Charity champion within his work and understood he could get free and confidential support from the Electrical Industries Charity.

Grant contacted the Charity and spoke to a welfare case worker who helped Grant tackle his gambling problem head on. Grant’s caseworker referred him for cognitive behavioural therapy which investigates thought patterns associated to negative behaviours. Grant had twelve sessions of therapy funded and sourced by the charity which helped him to establish coping techniques for when he felt the urge to gamble. The Charity also encouraged Grant to join a gamblers support group. Grant spoke to GamCare a free information and support line for problem gamblers and established a network who acted as a lifeline for Grant.

The Electrical Industries Charity also put Grant in touch with Step Change, a debt charity who provide practical financial advice and support. Step Change conducted a robust and detailed financial review and recommended bankruptcy as the most suitable option. Grant and the Electrical Industries Charity case work team remained in contact and he applied for short term financial assistance to help pay his bankruptcy fee. The Charity assessed his income and expenditure and after evaluation the welfare team awarded Grant the sum for the bankruptcy fee.

Grant’s bankruptcy application was successful, and he could start on a clean slate with a renewed sense of confidence that he could look after his financial and mental wellbeing. Grant has adopted budgeting techniques and has placed restrictions on his electronic devices which forbid gambling apps or websites. Grant now feels more in control of his health and his wellbeing and is looking to a more positive future.

The Electrical Industries Charity are here to support you. If you need assistance, please contact the welfare team on This email address is being protected from spambots. You need JavaScript enabled to view it. or call 0800 652 1618

Living beyond your means is pretty easy to do these days, especially since we live in a time when buying on credit has become the norm. But just because it seems normal doesn’t mean you aren’t doing a real disservice to your current and future well-being.

Here are eight red flags that you’re living a lifestyle you simply can’t afford:

1 - You let fear dictate your spending:

We all know how terrible it feels to miss out (or be left out) of fun social events due to financial constraints. But don’t let your FOMO (fear of missing out) dictate your spending.

“This can be as innocent as going out to eat when you’ve already exhausted your restaurant fund for the month, or as extreme as paying rent you can’t afford in order to keep up with your friends,” says Ruth Soukup, author of “Living Well, Spending Less: 12 Secrets to the Good Life.”

2 - You carry a balance on your credit card:

It’s not unusual to use a credit card as your primary method of payment. “Credit card companies offer all kinds of incentives to motivate consumers to use their cards,” says T. Michelle Jones, a vice president at Bryn Mawr Trust in Philadelphia. “It has become a way of life for many who no longer carry cash in their wallets.” And there’s no harm in doing so — and reaping those rewards points — as long as you’re paying off the balance each month. But if you carry a balance month to month, you’re spending more than you can afford. Get yourself back in the black in the next few months by doubling or tripling the minimum payment due, suggests consumer spending expert Andrea Woroch, and start carrying cash when you shop.

3 - You’re not saving at least 5%:

Everyone should save 10 to 15 percent of their total income. But if you can’t save at least 5 percent — even while paying off debt — this could be a sign that you’re living beyond your means.

How to do this? Give up things in the short term to be successful in the long term, says Snyder. “If you cut back each month and don’t go out to eat, or to the movies, or whatever it takes for you to spend less, you will have more money to save.”

4 - You have no emergency fund:

Part of the reason you need savings is to pay, in cash, for those inevitable emergency purchases, like if your car dies or you get hit with an excruciatingly high vet bill. Putting these kinds of expenses on a credit card or financing them with a loan will continue the cycle of living beyond what you can afford. R. Joseph Ritter Jr., a financial planner and founder of Zacchaeus Financial Counseling in Hope Sound, Florida, suggests trying build an emergency fund of about $2,500 — that way, you at least have a cushion when an unexpected expense crops up. “Try to do this within six months, and set aside as much as possible each month toward the goal,” he advises. “This is not your total emergency fund. It is simply a place to start.”

5 - You’re leasing a car you can’t afford:

A major financial red flag is leasing a vehicle you cannot afford to buy outright or finance, says investment advisor and Registered Financial Consultant Carlos Dias Jr. “If you can’t own it, don’t lease it,” he advises. “Essentially you are renting a temporary lifestyle that will end and may require you to put down more money that you could have applied to owning a car.

6 - You don’t have any money left at the end of the month:

“People who live paycheck to paycheck often believe they can’t save money or spend less because their lifestyle has become a habit,” Woroch says.

An easy way to jump-start savings and become more conscious of your spending decisions, according to financial expert J. Money is to enact a no-spend month.

“Allow yourself to spend money only on the bare necessities for 30 days — rent, bills, groceries — and cut out everything else,” he says. “No clothes shopping, no eating out, and especially no Amazon binges. Nothing puts your finances in check more than a consumption detox.”

7 - You’ve paid an overdraft fee:

Overdraft fees are another sign that you’re spending money you quite literally do not have. To avoid getting dinged for overdraft charges, use the cash envelope system to control your spending.

Divide expenses into categories that make sense to you — groceries, beauty, going out, and so on — and put cash in an envelope for each category. “When the cash [in a particular envelope] is gone, don’t use a credit or debit card,” he says. “Stop spending!”

8 - You’ve never set a budget:

“Having a written budget is one of the most important steps to financial freedom and living within your means,” Jones says. So if you’ve never set financial parameters for yourself — and you’re not filthy rich — chances are that you need to take an honest inventory of your income, spending, and savings goals. Not doing so will only cause you a great deal of stress, uncertainty, and even guilt. “Challenging a client to go ‘all cash’ for a month can be a wake-up call for someone who is not mindful or is in denial about his or her overspending,” says Brooklyn, New York-based financial planner Stephanie Genkin. Once you get a sense of your own patterns and habits you can work toward setting a realistic budget that allows you to save and spend more wisely.

Habit 1: Avoid making financial decisions when emotional

Studies have found that people who are sad will pay more for something or sell it for less, compared with those who are in a normal emotional state. Being highly stressed can lead to impulsive or irrational financial decisions. In these situations, the age-old advice of “sleeping on it” makes a lot of sense.

Habit 2: Tune out the noise

Avoid looking at your financial position too much. As a general rule, look at your cash position weekly and your investment portfolio yearly. If you’re investing for a 40 or 50 year time horizon, why worry about what is happening this week, month or year? As the legendary fund manager Peter Lynch put it: “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections, than has been lost in corrections.”

Habit 3: Just say no

Whether it’s a meal deal instead of just a sandwich or paint protection with your expensive new car, developing the habit of saying no to add-ons, upgrades or special deals stops you spending more money than you planned.

Habit 4: All pounds are equal

Research shows we treat money differently depending on where it comes from. We are more likely to spend a rebate than we are a bonus. Adopt the habit of treating all your inflows, whether salary and pension increases, tax rebates, bonuses or premium bond winnings the same as core income. That means directing it to the same spending priorities, including saving for your future self or reducing debt, as core income.

Habit 5: Forget Love Island

Watching a lot of reality TV or exposure to “lifestyle” social media has been found to increase people’s sense of inadequacy and insecurity, because they don’t conform to the unrealistic physical look or curated “perfect” lifestyles on show. This can lead to impulse and emotional spending to fill the void. If you can’t stop watching reality TV, at least be clear about what’s important to you in life and what matters.

Habit 6: Replace a bad habit with a good one

Your money habits may be highly ingrained, and you might think you can’t change. But, as long as you have a clear idea of what you stand for and what matters most in your life, you can then design your financial environment and routines so that it’s easier to develop habits that are conducive to your financial wellbeing. Swap regular bottles of wine for occasional drinking and use the saved money for a better habit.

Don't know where you stand with money? Take our free Money Health Check – you'll find out which areas to focus on and practical ways to improve your situation.

To get started on your budget, you’ll need to work out how much you spend on:

Household bills

Living costs

Financial products (insurance…)

Family and friends (presents…)

Travel (car costs, public transport…)

Leisure (holidays, sport, restaurants…)

Getting your budget on track

If you’re spending more than you have coming in, you need to work out where you can cut back. This could be as easy as making your lunch at home or cancelling a gym membership you don’t use. You could also keep a spending diary and keep a note of everything you buy in a month. Or, if you do most of your spending with a bank card, look at last month’s bank statement and work out where your money is going.

Be flexible

Life is unpredictable so try to review your budget and your spending if there’s a change, or at least every couple of months. You might get a pay rise, which means you can save more, or you might find your household bills increase.

Set a Savings Goal

Your first step is to have some emergency savings – money to fall back on if you have an emergency, such as a boiler breakdown or if you can’t work for a while. Try to get three months’ worth of expenses in an easy or instant access account. Don’t worry if you can’t save this straight away, but keep it as a target to aim for. The best way to save money is to pay some money into a savings account every month.

Once you’ve set aside your emergency fund, possible savings goals to consider might include:

• Buying a car without taking out a loan

• Taking a holiday without having to worry about the bills when you get back

• Having some extra money to draw on while you’re on maternity or paternity leave

Budgeting template for you to use from Martin Lewis:

If you don’t know where to start with your budgeting then why not try breaking down your income and expenditure using this spreadsheet.

Saving challenges which will help you put aside some cash:

The 52 Week Savings Challenge:

Week 1 = Save £1

Week 2 = Save £2

Week 3 = Save £3

Keep going through the rest of the year adding £1 to your saving amount, until you get to:

Week 52 = Save £52

Total saved: £1,378

The £5 saving challenge:

This tougher challenge is aimed at those who need something to help stop them spending:

Week 1 = Save £5

Week 2 = Save £10

Week 3 = Save £15

Keep multiplying £5 by the week of the year until you’re at:

Week 52 = Save £260

Total saved: £7,000

The monthly saving challenge:

Vary your savings each month by £25:

January = Save £25

February = Save £50

Increasing by £25 each month until you reach:

June & July = Save £150 each

Then start to decrease by £25 each month:

August = Save £125

September = Save £100

Total saved: £1,050

£1,500 a year saving challenge:

This challenge increases the amount you save throughout the week, and then resets for the next

week. For example if you started on a...

Monday = Save £1

Tuesday = Save £2

Wednesday = Save £3

Follow this up to Sunday, and then start over, saving £1 the following Monday

Total saved: £1,456

Alternatively, why not try sacrificing to save in a simpler way?

Your daily coffee might cost £3.20, why not make your coffee at home and save the £3.20 every day – that’s a whopping £1,168 for the year.

Find yourself eating out a lot? Swap a meal out on the weekend at a cost of £25 for a monthly dinner party in your home. You could potentially save £1,300 a year!

Splurging in the shops? Limit yourself to buy one item of clothing a month and make sure you really need it. Swapping the sprees for well planned spends can help save some serious cash.

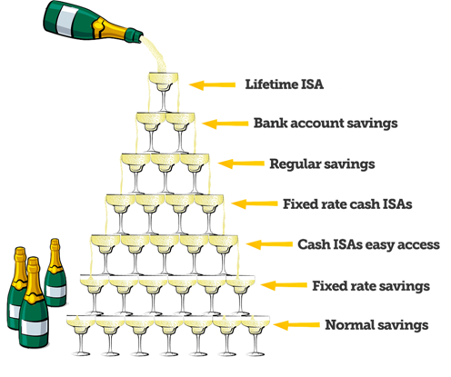

Want to start saving but don't know where to put your money? The Money Saving Expert Savings Fountain shows the best places to stash your cash!

Lifetime ISAs – is only for first-time buyers:

Anyone aged 18 to 39 can open a Lifetime ISA (LISA) and save up to £4,000/tax year into it, as a lump sum or by putting cash in when they can. Then the state adds a 25% bonus on top. So save £1,000 and you'll have £1,250 and save the full £4,000 and you'll have £5,000.

Bank accounts:

Bizarrely, some bank accounts' in-credit rates can beat easy-access savings accounts and ISAs – especially now all interest is paid to you without tax deducted. It's a loss-leader to attract banking customers – yet if you're prepared to switch accounts, it can be worthwhile.

Regular Savings:

Once you've filled any high-paying current account(s), start to trickle your money into regular savings. A regular savings account can pay high interest but it's only on a small amount of money.

Fixed rate cash ISAs:

Once you've maxed out regular savings accounts, move any money you don't need access to into an ISA. A cash ISA is just a savings account where the interest isn't taxed (so you keep all of it). Anyone over the age of 16 in the UK can put up to £20,000 in an ISA each tax year (April 6 - April 5) and once in, it stays tax-free year after year.

Easy Cash Access ISAS:

If you know you'll need access to your cash then you'll need to go for an easy-access ISA. Here there's no withdrawal restrictions, you can get your cash when you want it.

Fixed Rate Savings:

If you've still got money left, next consider whether you're prepared to lock it away without access – if so, you can get a higher return with a fixed-rate deal. Do bear in mind if rates rise over the term you can't switch, so think carefully before fixing for longer than a couple of years.

Easy-access savings:

With whatever money you've got left, anything you need access to stick in an easy-access savings account, where you can deposit and withdraw cash at your leisure. All the easy-access savings deals have a variable rate, so you need to monitor them to ensure the rate doesn't drop (switch away if it does).

If you need advice about your finances or debt here are some places you can turn to:

https://www.stepchange.org/how-we-help.aspx

StepChange provide free, expert debt advice. They offer the widest range of practical debt solutions of any provider in the UK. No matter how large or small your debt problem is, they can help.

https://www.moneyadviceservice.org.uk/en

Free and impartial money advice with advice and guides to help improve finances, tools and calculators to help you keep track and phone plus online support.

https://www.moneysavingexpert.com

TV favourite and money expert Martin Lewis covers all aspects of finance from cards and loans to bills to mortgages to banks and savings.